Dont be surprised or offended if a VC pushes back hard on the ask. Figures below like revenue, valuation, and round size are medians from conversations with founders. As a result, corporate VCs may find SaaS startups appealing investment targets. Says Bartlett, Its a tool in the toolbox that were going to see used more and more over the course of the next year or two, as companies try to draw out the runway to hit whatever next milestone they want for the subsequent financing. And investors dont expect the frenetic pace to slow. To calculate it, take your starting MRR, add expansion MRR while subtracting churn and contraction MRR and divide that total over your starting MRR. Learn on the go with our new app.

For every company we on-board into the Initialized portfolio at the seed level, we work backwards from the next milestones needed to successfully prove out whats needed to raise growth capital.

microcap.co is a blog I started in 2016 to provide good quality, free resources on how to value a company and how to analyze financials. We found that a minimum of 2 to 3X growth was necessary for getting to a Series A. Ghoshs statement indicates that some startups are actually able to raise capital at even higher multiples of their current revenue, enjoying pricing that can work out to 100 times their ARR for next year. Were generalists, but software is our core focus; 374 of the companies we talked to were SaaS. If the public markets continue to slide and companies struggle to grow, pressure on late-stage private valuations to rebase could mount. Startup Valuation Revenue Multiples Methodology, Revenue multiple of 6x 10x if the startup is growing at 40% per year and 1x 2x is the startup is growing at a modest 10% per year (, Revenue multiples of 10x to 20x times and more for the fast-growing, cloud-based businesses, in contrast to multiples of 1x to 5x for the rest (, Annual recurring revenue multiples of 15x 25x (2018 to 2021) for private cloud startups that are growing 100% 300% per year and about 5x 10x for public cloud startups that are growing about 30% per year (Bessemer Venture Partners State of the Cloud. For larger markets or markets in which the average order value is much larger, take rates tend to be lower while if your business is targeting something more niche, you can have a higher take rate. We often see companies at this stage optimizing for transactions (GMV) rather than take rate. Most recently, we invested in A-Frame Brands, which is developing personal care brands that emphasize sustainability and are designed for underrepresented communities, whose needs are less often addressed by the CPG industry. We hope this helps you figure out how to set intermediate milestones for your company and team as you go on to build a durable brand, employer and company., with a goal of leading public companies should aim to have their net dollar retention top 121 percent. There are lots of variables that make finding benchmarks harder for DTC companies, but in general, direct-to-consumer companies should aim for at least $500K to $2M in revenue before they raise their Series A. E-commerce. While this is like the barber telling you its time for a haircut (were VC after all), dont be surprised or offended if a VC pushes back hard on the ask. The median ask here was a heady 5.3x revenue of $3.0mm. Customers that purchase the product more frequently, whether it be due to the utility of the product or because they feel a sense of allegiance to the brand are worth more. Its ok to make a strong ask as most VC wont be turned off, but be ready to compromise. So, dont rely just on the revenue multiple to value the startup.

Some outstanding companies, like Away, notched revenues of more than $15M before raising their Series A round., Growth: Quickly growing revenue gets higher valuation multiples than slower growth. What valuations are founders asking for when they raise their Series A round?

The timeframe we expect to be very long, and there certainly are public market investors who also have a very long-term mentality, but I do think that gets tested very regularly, especially when things are moving so much and so quickly. I love marketplaces because they are inherently businesses that get better as the flywheel gets going. For marketplaces where this isnt the case, then margins of 80 percent might be possible. Average order size: This varies by product, but $150-$300+ was a good range. What Startup Valuation Revenue Multiple Should I Use? SaaS. I used a combination of researching what startup revenue multiples that actual venture deal makers used and I also analyzed a startup database. Revenue: Not all revenue is created equal. This is up slightly from the 4.8x ask we surveyed in July. The market you are trying to win needs to be expanding at a greater rate in order to generate more dollars and then over time as the flywheel of supply and demand gets set in place, the network effects of the marketplace can fuel an acceleration of growth. That is a ridiculously large range, so you have to consider additional factors when choosing a multiple for your startup valuation. To maintain strong multiples, private companies likely will need to demonstrate strong revenue growth, as we expect 2022 could see a return to fundamentals. One big difference is private market investors or VC investors, in general, have a built-in, go-long mentality, she said during the panel discussion. While there is a wealth of information around both publicly-traded companies and what you might need to close a first round of funding, theres not a lot of transparent data for in-between rounds. In contrast, net dollar retention focuses on the existing customer base but doesnt include new customer ARR.. For instance, a cloud tech startup that has experienced high growth (200%+ per year) will use the high range of the multiple, whereas a startup in a mature industry like manufacturing that has experienced a modest growth of 20% per year might use a revenue multiple thats more in the lower range. Factors to Consider When Using the Revenue Multiple, value the company using a revenue multiple. That is a good question and there is often a misunderstanding about what the term startup means. Yep. So startups are getting larger checks, earlier. At that time, investors were willing to pay premium prices for SaaS fundraising, even as deal sizes and valuations increased dramatically. Remember, youre partnering with an investor who is going to be with you for the next few years, not selling a car to a stranger youll never see again; treat the process like youre entering a partnership and youll find the optimal investor and outcome sooner. The Exchange estimated that the percentage of unicorns with valuations between $1 billion and $2 billion with $100 million in revenue was small. A flood of money invested against more modest deal flow has helped drive up startup valuations this year, along with deal sizes. Silicon Valley Bank is not responsible for any cost, claim or loss associated with your use of this material. One thing to understand about gathering data from actual venture deals is that how each startups valuation revenue multiple was calculated when they made the deal depends on several factors. But in order to really stand out, 4X or more is the target.. Marketplaces. Thats far above 2020s median Series A valuation of $33 million, also beating the previous record set in 2019 of $39 million. In July, the ask was 10.8x, so founders are getting more aggressive. However, the best companies will still get funded and command healthy multiples and valuations. Email me at sammy@blossomstreetventures.com.

Thats not a large enough sample size in our view. Founders with a goal of leading public companies should aim to have their net dollar retention top 121 percent.. document.getElementById("ak_js_1").setAttribute("value",(new Date()).getTime()); This site uses Akismet to reduce spam. Also recognize that asking for a higher valuation will probably lengthen the time youre out fundraising as it will take longer to find a VC that is forgiving on valuation. In the beginning, your business take rate might be set lower in order to capture more market share and customers and then over time, you might increase the take rate, which can result in discrepancies between net revenue growth and GMV growth. This material, including without limitation the statistical information herein, is provided for informational purposes only. The next largest category was transactional, whereby a company gets paid for each transaction it completes. Other Sectors. Ghosh took note of that approximation and wrote the following: Let me translate: Here the Boldstart investor is saying that its now common to invest in startups at a valuation that works out to 40 to 50 times those companies annual recurring revenue, or ARR. What is the average revenue multiple of other more established companies in the same industry? Lets talk about why the math can work out for startups with minimal revenues, rich valuations and lots of cash. The median revenue run rate was $2.3mm, the median round was $4mm, and the median pre-money valuation the founder was asking was $22mm. They have partnered with current U.S. Open tennis champion Naomi Osaka with Kinlo for sun and skincare and actress Gabrielle Union and her husband, former NBA professional, Dwanye Wade to launch a baby-care brand, Proudly. Figures like revenue, valuation, and round size are medians from conversations with founders. Global deal volume reached a record in the second quarter, but it just barely eked out a win over several quarters from 2018 and Q1 2021. However, now that its taking longer to raise money, particularly for late-stage startups, its worth revisiting the role of venture debt financing. Below is a summary of startup valuation revenue multiples from the aforementioned research findings of actual revenue multiples used which I reasonably categorized by the startups revenue growth. My separate data analysis actually corroborates what venture deal makers quoted, in that the range will fall somewhere between 1x and 25x.

And after removing the effects of outliers and extreme multiples, the range is 1.8x to 24.1x. #FCFestival returns to NYC this September! Better yet, get consumers to sign up for a subscription. Notify me of follow-up comments by email. Were still early in cloud adoption; you still have to imagine IT spending is only going up from here in a very big waythere are so many good things happening. Remember the valuations and revenue multiples presented arent necessarily what the founders got, but rather its what they asked for when talking to VC like us.

YOY GMV Growth: For an early-stage marketplace business, GMV needs to be expanding at a higher rate than revenue. The multiples for transactional revenue typical for DTCs are lower than for SAAS or any other recurring revenue structure. Does that mean that many startups are landing investments with smaller revenues than their stage (or capital base) would normally require? Internally, we have an entire internal bootcamp for founders where we run through multiple practices around how they should position their deck and story before going out to raise. Visit us at blossomstreetventures.com. LTV-CAC: Similar to DTC above, this measures the lifetime value of a customer divided by the business cost of acquiring them. In fact, the rule of thumb is a startup is considered not a startup anymore when it has reached the.

I hope you find these resources helpful thats the only reason why I write these articles! Depending on the nature of the business, aiming for $2M+ in net revenue on a run rate basis here would be the goal., Gross merchandise value (GMV): This is the total value of all merchandise, labor, services sold through a marketplace before the business take rate or the costs of goods or any expenses are accounted for. We are already in a different world from software companies here, because these companies have costs for producing goods to consider. Over the last nine years, Initialized has made many successful investments in direct-to-consumer products, from Soylent meal replacements to Eclipse dairy-free ice cream to Atoms shoes. Remember, youre partnering with an investor who is going to be with you for the next few years, not selling a car to a stranger youll never see again treat the process like youre entering a partnership and youll find the optimal investor and outcome sooner. Net revenues are generally the rubric that investors look at and we advise our companies to outline both the gross and net revenue numbers. AgTech Startup Smart Apply Raises $1.3M in Seed Round, Borderless tax compliance: Why we invested in Fonoa, Crunchbase crunches its way to fresh new capital, How to get startup fundraising rightthe fundamentals. We at Initialized decided to open source what weve seen internally with our own companies that have been able to raise follow-on rounds successfully. When do they expect to be cash flow positive? Your email address will not be published. Although macroeconomic factors and increased regulatory scrutiny could come into play, theres no indication of a slowdown in M&A activity for acquirors eager to purchase more pragmatically priced companies. .

When is a Startup Not Considered Startup Anymore? My separate data analysis actually corroborates what venture deal makers quoted, in that the range will fall somewhere between 1x and 25x.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'microcap_co-large-leaderboard-2','ezslot_4',110,'0','0'])};if(typeof __ez_fad_position!='undefined'){__ez_fad_position('div-gpt-ad-microcap_co-large-leaderboard-2-0')}; The range of the revenue multiple that you can use to value a startup based on triangulating different venture capital sources and my own research & analysis is between 1x to 25x. These are businesses with no tech that literally sell a food or beverage in grocery stores.  Multiples requested by quarter are below; the multiple has come steadily down and is now 6.74x.

Multiples requested by quarter are below; the multiple has come steadily down and is now 6.74x.

Your approach. For example, The Wall Street Journals Christopher Mims asked if low startup revenues compared to their valuations indicates that there are a great many houses of cards set to fall in time. We looked at the metrics of more than 20 companies half in the Initialized portfolio when they raised their Series A, and half with publicly available data from venture-backed consumer brands like Harrys, Casper, and All-Birds.

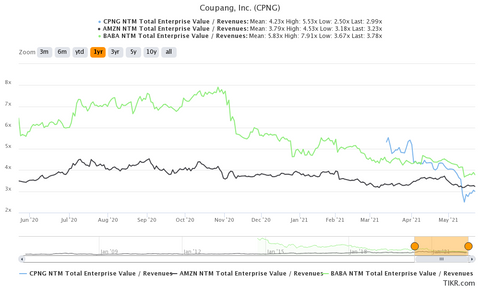

Do they have a sustainable business going forward? The range of the revenue multiple that you can use to value a startup based on triangulating different venture capital sources and my own research & analysis is between. For consumer packaged goods, a bigger basket-size is better than a smaller basket-size; however cheaper items make up for that by being something that you constantly need to replenish like dog food or diapers. The ask there was a median 12.8x revenue. Thats what NTM means: next 12 months. Although historically, revenue growth was the primary driver of revenue multiples for SaaS startups, 2021 saw this relationship bend, which could signal other factors such as profitability, vision, management potential, and addressable market are the must-haves for investors. After an unprecedented year that saw sky-high valuations and record levels of U.S. venture capital (VC) investment in the software-as-a-service (SaaS) sector, the investment pace is expected to temperin 2022 as market conditions change. Despite the shifting fundraising dynamics, webinar panelist Tiffany Luck, investor at GGV Capital, still sees an upside for SaaS startups seeking VC funding.